The week is over, and a quick assessment would go something like this:

1) Whatever the Bush administration does, the markets don't believe it.

2) Whatever John McCain says, the voters don't believe it (look at the last polls and trends here).

In other words, this is a crisis of trust in the ability of government to solve the financial chaos and the sentiment can't possibly turn around before the world is sure that the Bush-Cheney crowd has packed its luggage for good. That means things might start recover not on November 5, but more likely on January 20, when Obama will be sworn in (a McCain's victory will bring the country back to the era of barter, so this possibility will not be discussed here).

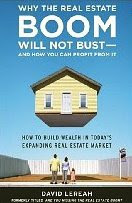

Everything started with the real estate bubble, therefore we should start from there.

Houses are normally purchased on credit, and while an individual can pay back his mortgage debt by selling the house to someone else, society as a whole can’t do that. Mortgage servicing, therefore, has to be financed from its own income (real estate is only marginally influenced by foreigners's buying), income which is derived from selling goods and services. The ratio of asset prices to consumer prices gives the best measure of how hard or how easy that is to achieve. While there is no obvious “magic number” for the ratio (and the servicing cost of debt will rise and fall with changes in interest rates), its level tells us how sustainable house prices are at any point in time. A low ratio implies very affordable housing; a high one implies expensive housing, and one that lasts in the long term implies a bubble.

The bubble in US housing prices is obvious: between 1892 and 1995, the average for this index was 103, while its previous peak value–set over a century ago in 1894–was 133.6. This long run maximum was breached in 1989, and the housing bubble continued even after the Stock Market "dot com" bubble temporarily burst in 2001. The house index peaked in 2004 at 228, over twice the historic norm, and 70% above the highest level the index had reached in 1894. If the index reverts to anything like its historic norm, then US house prices have much further to fall. Even now, after a 10-15% fall from its peak, the index is still almost twice the pre-1995 long term average.

This means that the banks will become owners of more and more houses, because less and less families will be able to pay their mortgages, set at high and unrealistic levels. And the prices for more houses will go down more and more, stressing the balance sheet of the soon-to-be-nationalized banks even further. Nobody knows where the bottom is. Read this about the Panic of 2008.